how to check my unemployment tax refund online

Select Check the Status of Your Refund found on the left side of the Welcome Page. Account Services or Guest Services.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Many states now offer online access to your unemployment claim information.

. Even if you applied in person you might have the option to set up a PUA unemployment login. Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are. Visit IRSgov and log in to your account.

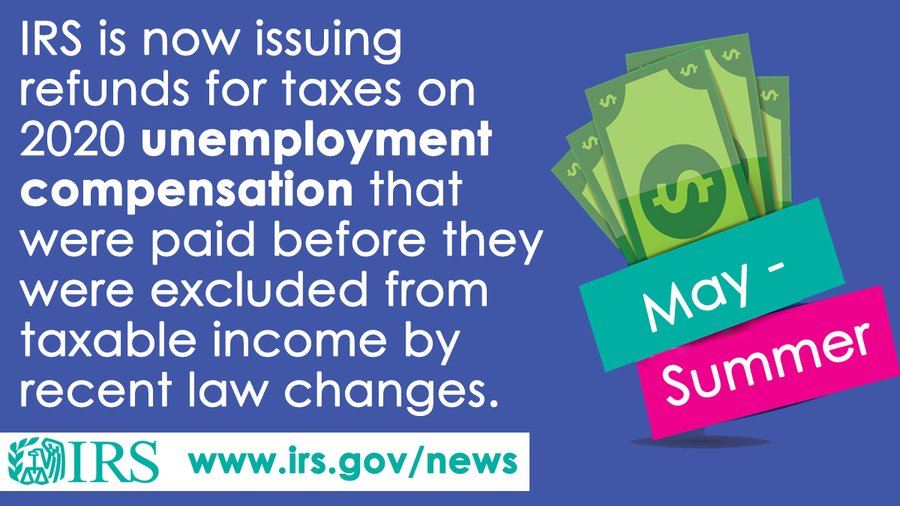

If you havent opened an account with the IRS this will take some time as. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. How do I check on my unemployment tax refund.

Another way is to check your tax transcript if you have an online account with the IRS. So run the numbers on your unemployment and other income before filing season arrives to at least get an idea of where youll stand tax-wise. TurboTax cannot track or predict when it will be sent.

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. 6 Unemployment Insurance your state or federal income tax refunds may be garnished to satisfy any money owed you can be denied unemployment benefits in the future you must repay the benefits you received plus interest and penalties. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. Check Application Status Online. HOUSEHOLDS who are waiting for unemployment tax refunds can check the status of the payment.

The IRS has already sent out 87 million. The IRS has not provided a way for you to track it so all you can do is wait for the refund to arrive. Online portal allows you to track your IRS refund.

The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. The only way to see if the IRS processed your refund online is by viewing your tax transcript. Online Account allows you to securely access more information about your individual account.

An immediate way to see if the IRS processed your refund is by viewing your tax records online. Visit IRSgov and log in to your account. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. If you were expecting a federal tax refund and did not receive it check the IRSWheres My Refund page. Department of Labors Contacts for State UI Tax.

One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. Updated March 23 2022 A1. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022.

The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds. You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools. Sadly you cant track the cash in the way you can track other tax refunds.

For a list of state unemployment tax agencies visit the US. Visit IRSgov and log in to your. For example if you requested a refund of 375 enter 375.

24 hours after e-filing. But know that if you dont pay tax on unemployment via withholding or estimated tax payments you could face a tax bill and possible underpayment penalties when you file your return. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

If you use Account Services select My Return Status once you have logged inNote. If you havent opened an account with the. Viewing your tax records online is a quick way to determine if the IRS processed your refund.

Another way is to check your tax transcript if you have an online account with the IRS. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. Enter the whole dollar amount of the refund you requested. Heres how to check online.

When you create a MILogin account you are only required to answer the verification questions one time for each tax year. Postal Service your refund check may be returned to the IRS. Still they may not provide information on the status of your unemployment tax refund.

Refund checks are mailed to your last known address. Check your unemployment refund status by entering the following information to verify your identity. Youll need to enter your Social Security number filing status and the exact whole dollar.

4 weeks after you mailed your return. This lets you use your personal login information to see the status of your benefits claim. If you move without notifying the IRS or the US.

Will I receive a 10200 refund. Check My Refund Status. Heres how to check your tax transcript online.

There are two options to access your account information. As the IRS is in the middle of a busy tax season and is also overseeing the distribution of. Most employers pay both a Federal and a state unemployment tax.

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Heres how to check your tax transcript online. Millions of people are getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became lawgetting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. Unemployment benefits are generally treated as taxable income according to the IRS. This is available under View Tax Records then click the Get Transcript button and choose the.

Stimulus Checks For Ssi And Ssdi 12 Key Things To Know About Your Third Payment Tax Refund Irs The Motley Fool

10 200 Unemployment Tax Free Refund Update How To Check Your Refund Date Ca Edd And All States Youtube

Here S How To Track Your Unemployment Tax Refund From The Irs

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Scope Of Management Accounting Management Guru Tax Prep Checklist Small Business Tax Tax Prep

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Abc10 Com

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

2 621 Unemployment Tax Stock Photos Pictures Royalty Free Images Istock

Confused About Unemployment Tax Refund Question In Comments R Irs

Generalcontractorbusiness Bookkeeping Business Small Business Accounting Business Tax

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com